Day Of Runes

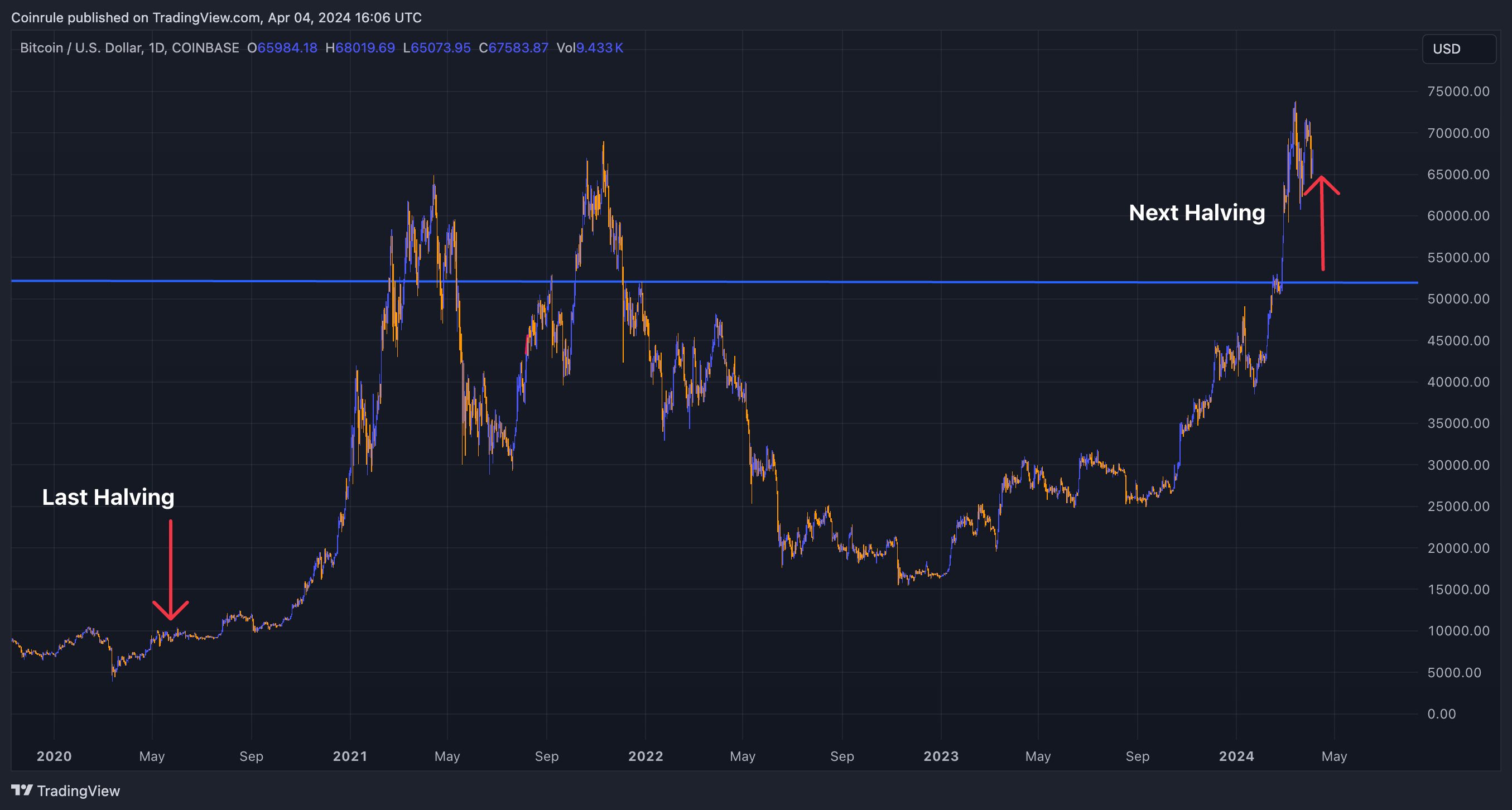

When you are reading this, Bitcoin’s fourth halving is imminent. The reward that miners will receive for each block every 10 minutes will drop from 625 Bitcoins to 3,125 Bitcoins. Bitcoin’s halving will result in a reduction of the annual Bitcoin supply from 1.6% to 0.8%. But this halving will also bring the launch of the highly anticipated protocol and Bitcoin Token Standard “Runes”. Runes allows the creation and trading of altcoins on Bitcoin. Unlike Ordinals, which essentially are…