Speaking of Cryptocurrencies, some people say “I am only here for the technology!” and they are not minding the daily price moves. It can be true for some, but the vast majority of those buying and selling coins are doing it for one main reason: to make money. So what are the best strategies to manage your crypto?

Cryptocurrencies are likely to represent the asset class with the best risk/reward profile for investors. No wonder, since cryptocurrency trading can be so appealing in terms of potential returns. But how to make money with crypto?

Long Strategies

In the trading terminology, a long strategy means to have a position that benefits in case of a price increase of the underlying asset. When you buy a coin, you are establishing a long position, expecting that the price will go up from there. You can place a single buy order and keep those coins as a long term investment. You are HODLing no matter how the price will move because you believe that in the future, the price will be significantly higher. In this case, you may want to store your coins safely in a dedicated wallet. Nowadays there are plenty of options, depending on your needs. As a long-term Hodler, here you will find a list of the best ways to store your coins.

Another option is to place different buy orders at different times. In this way, you are managing the volatility of the price. If you spread your buy orders across a sufficiently long period, you can get a lower average price because you take advantage of the times when the price goes down. This approach is known as DCA, Dollar-Cost Averaging.

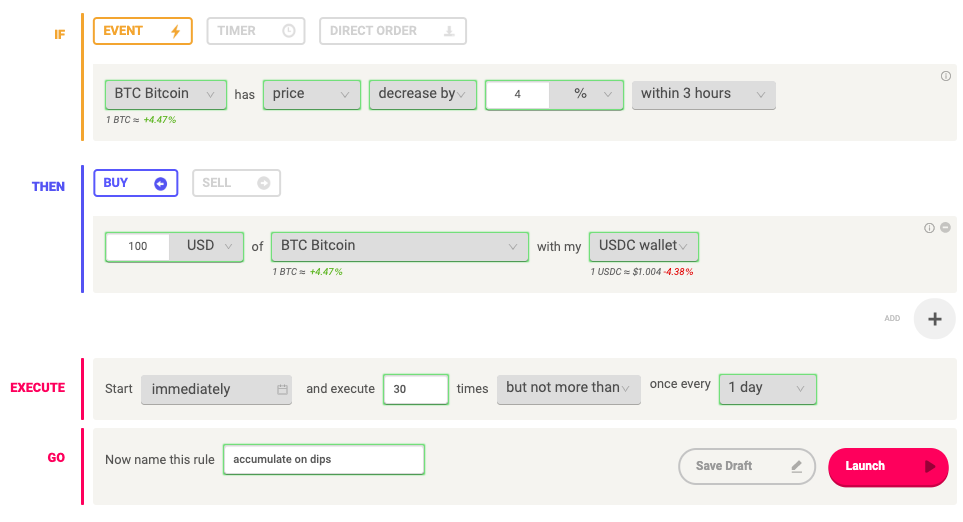

A way to optimise such a strategy is to buy more in periods when the price is drifting lower, so you will lower even more your average buy price.

A trading bot is more efficient than a trader doing this because an automated trading system has no feelings, so it’s not scared of buying in times of drawdown. And these are exactly the times when the best opportunities come!

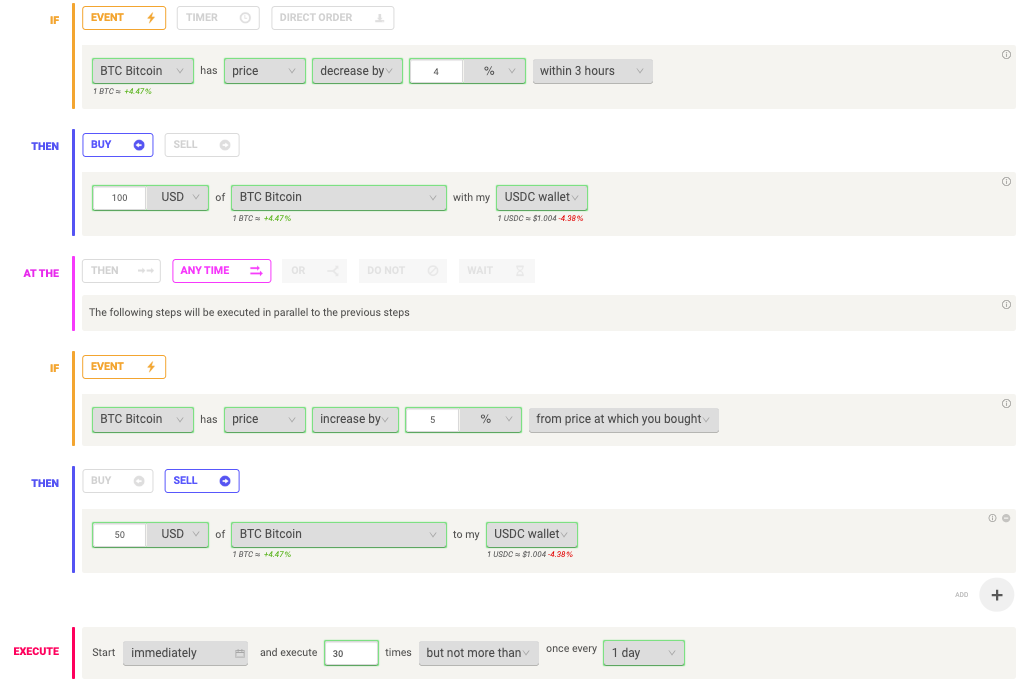

Do you want to optimise this strategy even more? While you accumulate your favourite coin, at the same time you can also take profit on a part of your holdings. In this way, you can sell back your coins to your base currency, and you will have more allocation to run your strategy longer.

Long/Short Strategies

If you adopt a long-only strategy, you should be prepared to withstand the volatility of the market. Maybe you are not sensitive to the daily price swings and the news related to the market going down for a few days don’t affect you. If they do, on the other hand, you could evaluate the option of also profiting from the market downturns. This is the best strategies to manage your crypto if you are an active trader.

If you have a portfolio of cryptocurrencies, it could be profitable to open a position that profits from the price going down. You would hedge your portfolio, reducing your risk and the volatility of your returns.

Nowadays, there are many options to make money in crypto, whether the price goes up or down. Years ago the only reliable option was to open an account on Bitmex. With time, other competitors came into the spotlights. Bybit is now one of the best exchanges where you can trade the most liquid cryptocurrencies using derivatives.

In 2019, all the major crypto exchanges added the possibility to short Bitcoin or other coins using different options. Kraken is one of the oldest exchanges and among the most secure ones. They recently released the option of trading crypto derivatives. The interface is user-friendly, and you are allowed to trade with low leverage. Perfect if you are looking for an exchange to learn how to trade with these kinds of instruments.

Making money with these products can be more difficult and involves investing time in learning and analysing the market daily. Here you can find some trading tips that can be useful.

Passive Income

If you prefer a less active approach, this could be the best strategies to manage your crypto wallet with little or no effort. You can increase your assets in the long-term HODLing your coins and earning interest from them. There are two similar approaches you could adopt.

Crypto Interest

You can lend your assets into platforms that will reward you with a periodic interest rate. It works exactly like a bank account that accrues interest on your deposits. This solution is quite simple and it doesn’t require much effort on your side.

The main decision you should make is whether you want to use a decentralised or centralised entity. When choosing a centralised/custodial company to handle your funds, you should trust that company. Hacking is a widespread issue in the crypto business, and it’s a risk that you should assess very carefully. Celsius and Blockfi are among the major companies offering interests on a relatively broad range of cryptocurrencies.

Some of the most recognised exchanges are also adding interest among the offered services. If you already hold your coins on exchanges like Binance, Bitfinex or Liquid you may want to choose to lend your coins within the exchange for convenience reasons.

On the other hand, when depositing your coins into a decentralised protocol, your trust goes to the smart-contract that handles your funds. Generally, this is a more secure way to store your assets, but bear in mind to verify that the smart-contract has been audited or certified by a third-party company. A non-audited smart contract could be hacked just like a centralised company. The most well-know protocols you can use to deposit ERC-20 token and earn interest are dYdX, Maker, Compound and Fulcrum.

Not all coins are eligible to earn interest. Usually, the centralised platforms accept only the most liquid cryptocurrencies while the decentralised platforms only allow deposits in Ethereum-based coins.

Staking

If you hold a coin based on a Proof-of-Stake consensus algorithm, you have the chance to stake your coins and earn interest as well. You can read more about the difference between PoS and Proof-of-Work coins here.

In some cases, you can easily set up your node on the blockchain ready for staking and earning the return directly into your wallet. Some other times, setting up a node is not so easy, or you would need a minimum amount of coins to start validating the transactions (and getting the rewards from the blocks mined). In these cases, platforms like StakingLabs will stake the coins for you. As always, do your own research before depositing your coins on third-party applications. There is an increasing demand for this option, and recently, major exchanges like Binance, Kucoin and Okex have started adding staking options.

Mining

Are you a tech-geek and you are really interested in having more skin in the game of crypto? Then you could evaluate the option of mining cryptocurrencies. Most of the cryptocurrencies which highest usage are based on PoW protocols. That means that you need dedicated hardware to perform a very complex mathematical calculation to mine a block. The process of mining blocks is what makes PoW cryptocurrencies work. Each transaction to be validated must be included in a sequence of blocks. The first that mines a block gets the transaction fees included in that block plus new coins minted. This is how Bitcoin or Ethereum work.

As we said, you need specific hardware to mine cryptocurrencies and to make more money from mining you need to optimise the settings so that the performance of your rig will improve. On top of that, each cryptocurrency has its specific algorithm, so the decision of what coin you want to mine has a direct impact on the hardware you will need.

Pros & Cons

Mining cryptocurrencies is generally risky. On one side, the cost of setting up and running your equipment is typically paid in fiat currency. On the other hand, the return you earn is denominated in cryptocurrency. The price volatility can make mining cryptocurrencies an unprofitable business for prolonged periods. Nevertheless, if you consider the mining cost as an investment, in the long term, the coins you accumulated could bear significant profits if the price increases.

You can also use an automated system to sell periodically part of the coins rewarded via mining. For example, you can deposit your coins on your preferred exchange and then sell them when market conditions are more favourable. That would be quite a smart way of mining!

All the best strategies to manage your crypto could have pros and cons. You can choose the one that fits your preferences better, or you can also choose a blended approach, assigning part of your investment allocation to some of these strategies to find the perfect combination for your needs.