Leverage trading allows traders to bet on the future price and earn regardless of the price’s direction. Long-standing exchanges such as Binance and Kraken have added derivatives trading to their product offering. How to trade crypto derivatives?

Coinrule has now launched Steroid Leverage, and now any trader can use Coinrule to automate their Leverage trading. Leverage trading allows traders to capture immense opportunities to grow their capital drastically -1000x or even more! But this can be challenging, especially for novice traders that are just getting started.

What is Leveraged Trading?

Leverage trading allows a trader to open a leveraged position, borrowing funds against collateral (the so-called ‘margin’) to buy more than he can with his capital. Some exchanges allow leverage positions up to 100x; the degree of leverage depends on the amount of margin as collateral for opening the position.

If a trader has $1,000, he can open a normal position in Bitcoin; this will result in him holding 0.084 BTC. However, with the leverage, he can now open a position valued up to $100,000, approximately 8.4 BTC. If the price moves up by 1%, the trader’s return would be $1,000 as opposed to $10 without leverage.

As the upside increases, so does the downside; when leverage increases, the trader takes on higher risk, small price fluctuations can cause automatic liquidation. A trader in a fast-paced market such as the crypto market requires automated trading tools to trade crypto derivatives.

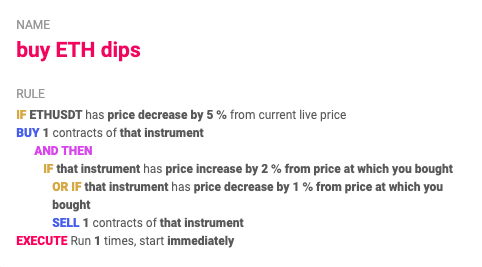

Managing leverage positions can be a tedious task requiring constant monitoring of market conditions to secure profits and cut losses promptly. With Coinrules Steroid Leverage smart-assistant, you can now create rules to trade crypto derivatives. This is an example of such a rule on Coinrule:

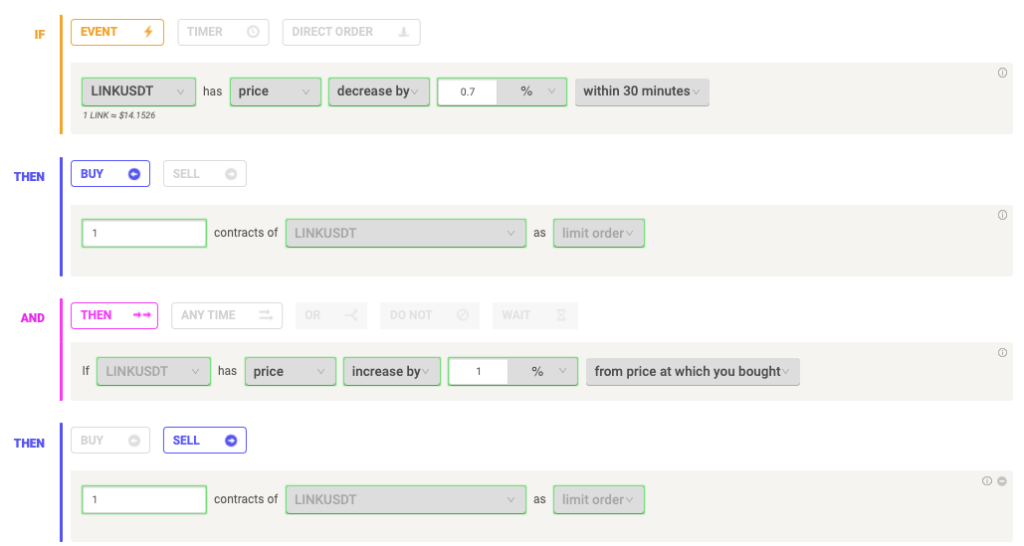

On Coinrule, a strategy such as this can be set up with just a few clicks and will be running 24/7. Another excellent method that you can use with Coinrule is to open and close positions in a short time, allowing traders to profit from small price changes. This method is scalping. Since derivative exchanges, on average, charge a low transaction fee, scalping trades can be more profitable.

How do traders benefit from Leverage?

Primarily the benefit of using leverage is increasing your return with the same amount of invested capital, but one must keep in mind that this is risky! So there are other, even more, practical reasons for using leverage and trading derivatives to add long-term value.

Short-term price speculation

Trading with leverage allows a trader to open positions that can benefit from the price upside or downsides. Meaning the trader can profit from a price increase or decrease. Thus, by taking advantage of each wave, swing trading strategies become very profitable.

Short selling allows the trader to benefit from price drops without having to hold the underlying asset. As a result, catching opportunities and capitalizing on price moves becomes much faster.

Superior market liquidity

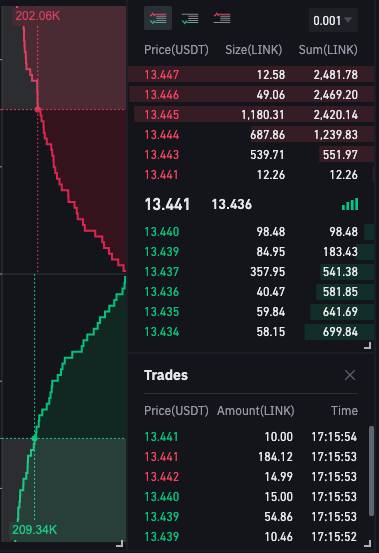

Entering and exiting cryptocurrency positions can be expensive due to the low liquidity that can drive up the price, directly affecting a trader’s profits, especially in strategies intended to capitalize on marginal price swings.

Leverage markets encourage traders to increase the orders’ sizes, leading to more liquidity in the order book, creating the optimal conditions for automatic bots and market makers that, in turn, contribute to the deepening of the marketer and positively affect the price.

Portfolio hedging

In an uncertain market like cryptocurrency, it is vital to protect yourself against losses. Hedging your positions using derivatives protects your portfolio from sudden price drops.

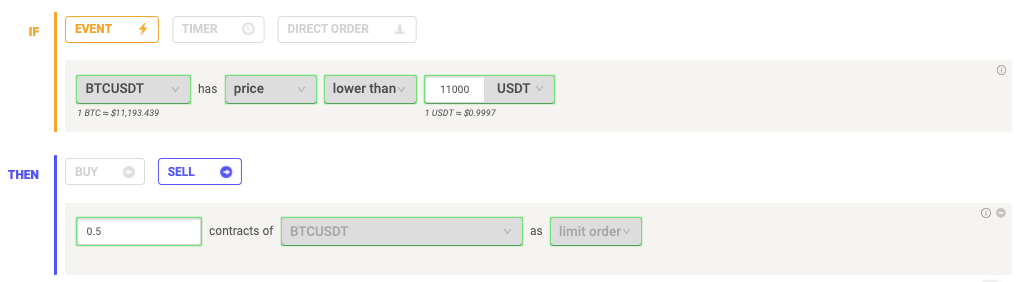

During a market crash, investors typically don’t have the right tools or plan to respond promptly. Closing open positions will usually take time, especially if the investor holds several coins. However, a single short position on a derivative instrument can massively reduce the overall loss. As a result, the trader’s portfolio’s downside risk decreased without the need to sell the assets held.

An example would be a trader that holds $5,000 worth of diversified crypto assets. To protect his portfolio during times of uncertainty, he decides to invest in an inverse financial product by short-selling BTC perpetual swaps hedging against risk. The profit from the derivative contract in the event a drop occurs would offset the loss that was incurred due to a market crash.

While this strategy is not common between novice traders, more experienced traders tend to do this regularly to manage their risk exposure. Through Steroid Leverage, Coinrule empowers everyday traders to have more advanced control over their assets, regardless of market direction.

Use Steroid Leverage while managing risk

A prevalent practice between professional traders is using stop-losses on all their trades to protect themselves from large unexpected losses. Beginner traders usually don’t use them for every position they take. If they do it, they usually do that when it’s too late and the loss too large to handle.

This can be done easily with Coinrule, and many different variations can be created for rules that incorporate stop losses. Using Coinrule, users can create rules that trade crypto derivatives according to pre-set conditions. Here is an example:

Coinrule has developed tools that empower traders to use leverage trading, and users can now create rules using a simple IFTTT logic. Once the rule is live, the bot checks the conditions 24/7, allowing traders to maximize their returns without worrying about liquidation. Derivative markets are ideal markets for algorithmic trading because of their nature that requires quick decision making and swift reaction time.