As those of you that trade regularly probably already know, liquidity is one of the most critical aspects of a market that investors care about.

Imagine you developed the perfect trading strategy, and you can’t buy or sell an asset because there are no counterparties available to trade with. Then your great strategy is totally useless.

The liquidity of the market increases if:

- The size of the orders is relatively large

- The price of the sellers and buyers are very close together (the bid/ask spread is low).

Another reason to keep a close eye on the volume of a market is that it is a key technical indicator. High volume or low volume in a given period can confirm or invalidate the signals provided by other indicators.

Traders rely so much on volume data, yet fake volume reported by many crypto-exchanges is a common practice.

How does this data manipulation work?

The most popular way to fake trade volume is Wash Trading. The same market participant buys and sells the asset at the same time.

There is no significant impact on the market, but the exchange disseminates misleading information to other market participants. As a comparison, regulated financial markets strictly forbid and punish this practice.

How to recognize wash trades?

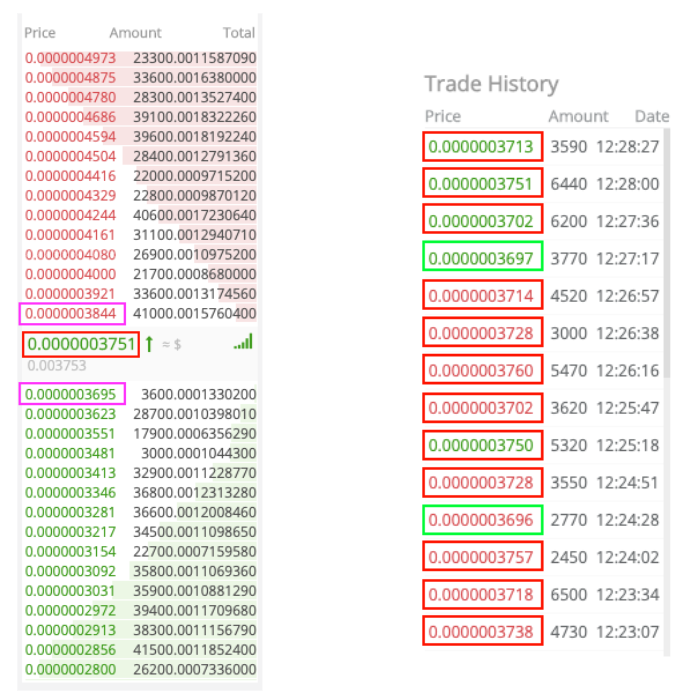

It’s relatively easy to get clues that trades are probably fake looking at the order book. Usually, these trades happen when the prices of the best buyer and seller are relatively distant.

The trader can easily buy and sell the asset at a price in the middle, being sure that he won’t cross any other order. Here is an example.

As you can see, most of the trades don’t happen against the best buyer or the best seller as you would expect in an efficient market. Of course, this is not 100% proof that wash trades are happening. On the other side, the fact that suspect trades are happening on a regular base is a reasonable source of suspicion that something is going on.

Coinrule’s position on the topic

Wash trades are executed by trading bots explicitly developed with that purpose. We are, of course, concerned that our platform could be used to run these strategies on the market.

That said, we want to state that in no way do we encourage this behavior, and we are considering putting in place internal controls to prevent such activities.

Cryptocurrency markets need more transparency and a certain level of regulation to attract more traders and investors. Each company that runs a crypto-related business should do its part regulating their operations and trying to prevent any illicit behavior.

Coinrule will always do its best to contribute to a positive, fair, and sustainable development of the cryptocurrencies markets. The only aim for automated trading strategies should be to increase your capital and let you trade more comfortably with less stress.

Trade safe!